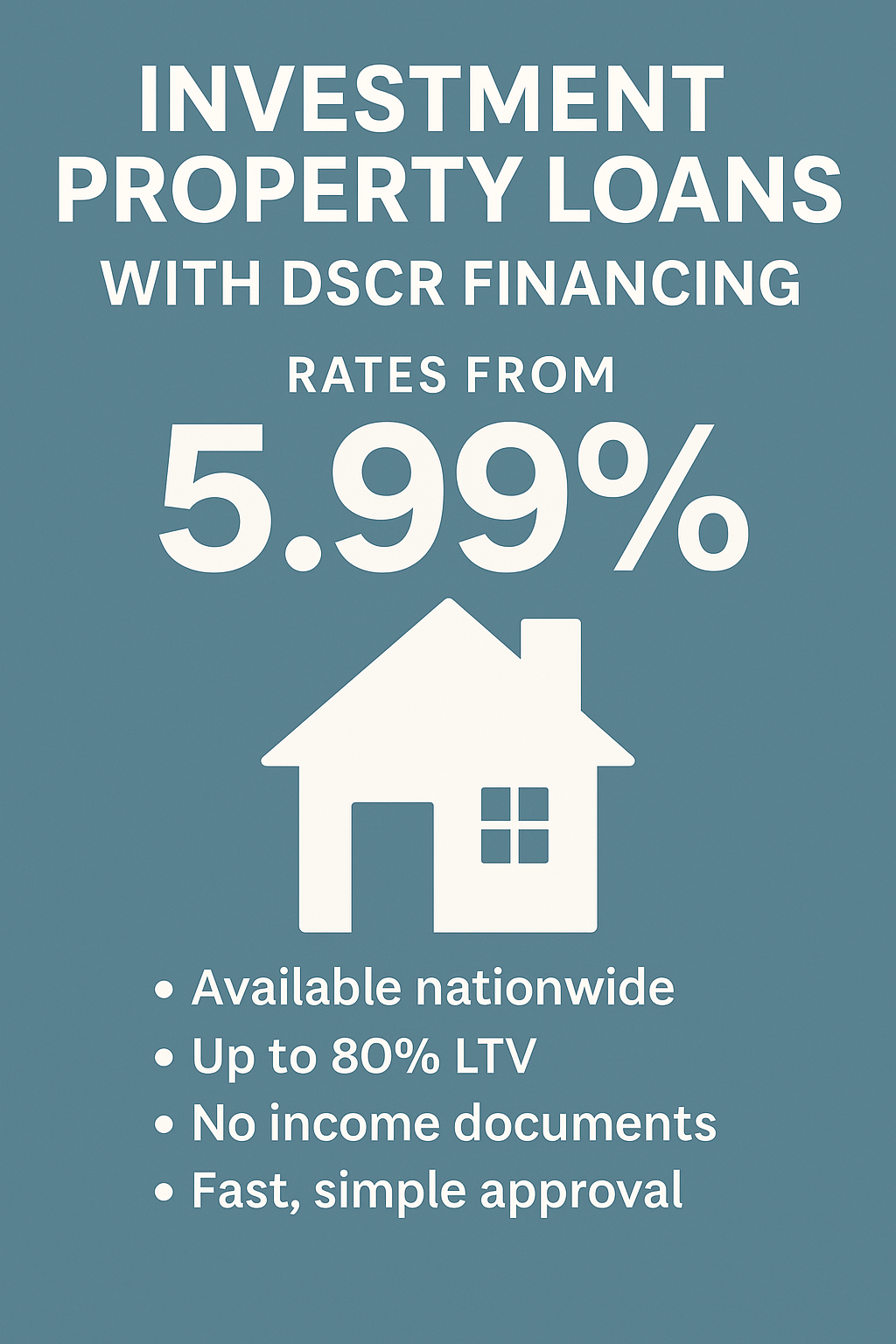

Nationwide Investment Property Loans Starting at 5.99%

Why DSCR Loans Are Beating Conventional Rates for Investors in 2025

(Optimized for Home Loans in San Diego, CA)

Investors across the country - and especially those buying investment property in San Diego - are seeing a major shift in the lending landscape:

For the first time in years, DSCR loan rates are often LOWER than traditional conventional investment property rates.

With nationwide DSCR rates now starting at 5.99%, real estate investors can scale portfolios faster, qualify with fewer restrictions, and secure better long-term cash flow than most bank-based investment loans.

Whether you invest locally or across multiple states, this is the strongest DSCR market we've had in years.

🔥 What Makes DSCR Loans So Powerful Right Now?

Traditional investment property loans typically come with:

Verify my mortgage eligibility (Feb 15th, 2026)-

Higher rates

-

Heavy income documentation

-

Strict underwriting

Verify my mortgage eligibility (Feb 15th, 2026) -

Lower LTV limits

-

Slow approvals

But DSCR loans operate differently. Instead of looking at you, they look at the property's income performance.

Verify my mortgage eligibility (Feb 15th, 2026)You qualify based on the Debt Service Coverage Ratio - meaning the property's rental income covers its payment.

And today's DSCR pricing (starting at 5.99% nationwide) is beating many banking products.

🏡 Why This Matters for Home Loans in San Diego, CA

San Diego investors face:

Verify my mortgage eligibility (Feb 15th, 2026)-

Higher price points

-

Lower inventory

-

More competitive offers

Verify my mortgage eligibility (Feb 15th, 2026) -

Pressure to close quickly

-

Higher conventional investment rates

DSCR financing gives San Diego investors the leverage to:

✔ Compete with cash buyers

✔ Close faster than conventional loans

✔ Buy long-term rentals or short-term rentals

✔ Avoid W-2s, tax returns, or bank scrutiny

✔ Lock in a payment that actually cash flows

This is particularly valuable for:

-

San Diego Home Mortgage investors

-

Hard Money Loans in San Diego borrowers transitioning to long-term financing

Verify my mortgage eligibility (Feb 15th, 2026) -

Bridge Loans San Diego users who need to take out a short-term loan

-

Investors wanting 80% LTV without conventional hurdles

📈 Why DSCR Loans Are Currently Lower Than Conventional Rates

Conventional lenders have increased their margins on:

Verify my mortgage eligibility (Feb 15th, 2026)-

Investment homes

-

Second homes

-

High-DTI borrowers

Verify my mortgage eligibility (Feb 15th, 2026) -

Self-employed applicants

Meanwhile, private lenders have shifted capital into rental lending - creating stronger competition and driving DSCR pricing down.

Today, many investors are shocked to discover:

Verify my mortgage eligibility (Feb 15th, 2026)💥 DSCR at 5.99% is often lower than conventional bank rates above 6.5% - 7.25%.

This creates a rare window of opportunity.

🌴 DSCR Loan San Diego - Local Benefits

Investors in San Diego benefit even more from DSCR lending because:

-

The rental market is strong

Verify my mortgage eligibility (Feb 15th, 2026) -

Short-term rentals (STRs) cash flow at higher levels

-

Long-term rentals stay consistently occupied

-

DSCR lenders allow Airbnb, VRBO, & STR qualification

Verify my mortgage eligibility (Feb 15th, 2026) -

DSCR loans can be used on portfolio builds

Plus, DSCR offers:

-

Quick closings (10 - 14 days)

Verify my mortgage eligibility (Feb 15th, 2026) -

No DTI calculations

-

No W-2s or tax returns

-

No paystubs or employment verification

Verify my mortgage eligibility (Feb 15th, 2026) -

Cash-out options up to 80%

🔧 DSCR vs Hard Money Loans for Real Estate San Diego

Many San Diego investors start with hard money loans for:

-

Fix & flips

Verify my mortgage eligibility (Feb 15th, 2026) -

Rehab

-

Speed

Then they refinance into a DSCR loan for:

Verify my mortgage eligibility (Feb 15th, 2026)-

Lower payments

-

Long-term cash flow

-

Lower rates (5.99% vs 9 - 11% hard money)

Verify my mortgage eligibility (Feb 15th, 2026)

We are one of the few lenders offering both:

✔ Hard Money Loans for Real Estate San Diego

✔ DSCR Loan San Diego

✔ San Diego Bridge Loans Lender

✔ Investment Property Loans San Diego

- all under one roof.

🧭 Who Qualifies for a DSCR Loan?

If the property rents, you qualify. No personal income required.

Verify my mortgage eligibility (Feb 15th, 2026)Perfect for:

-

First-time investors

-

Seasoned landlords

Verify my mortgage eligibility (Feb 15th, 2026) -

Airbnb operators

-

Portfolio investors

-

Self-employed borrowers

Verify my mortgage eligibility (Feb 15th, 2026) -

Retirees

-

1099 or gig-economy earners

-

Anyone who wants fast approval

Verify my mortgage eligibility (Feb 15th, 2026)

🚀 Why Investors Nationwide Are Choosing DSCR Loans (Now More Than Ever)

✔ Nationwide lending in 40+ states

✔ Rates starting at 5.99%

✔ Up to 80% LTV

✔ Use long-term or short-term rental income

✔ No income documents

✔ 30-year fixed, ARM, interest-only options

✔ Cash-out refi for future projects

It's a flexible, investor-friendly solution built for long-term wealth.

🏁 Final Takeaway

If you’re growing your rental portfolio - locally or nationwide - the current DSCR environment is one of the strongest we've seen in years. With pricing lower than many conventional investment loans, now is the time to take advantage of:

-

Lower rates

Verify my mortgage eligibility (Feb 15th, 2026) -

Easier qualification

-

Stronger cash flow

-

Faster closings

Verify my mortgage eligibility (Feb 15th, 2026)

Whether you invest in San Diego, Florida, Texas, Arizona, or nationwide - we're here to help you scale with confidence.

📞 800.558.0496

🌐 ElixirMortgageLending.com

NMLS# 1704105 | BRE #01901050

San Diego's trusted DSCR, Bridge Loan & Hard Money experts.