The History & Benefits of VA Home Loans — What Every Veteran Should Know

Helping Veterans Build, Buy, and Keep Their Homes - Since 1944

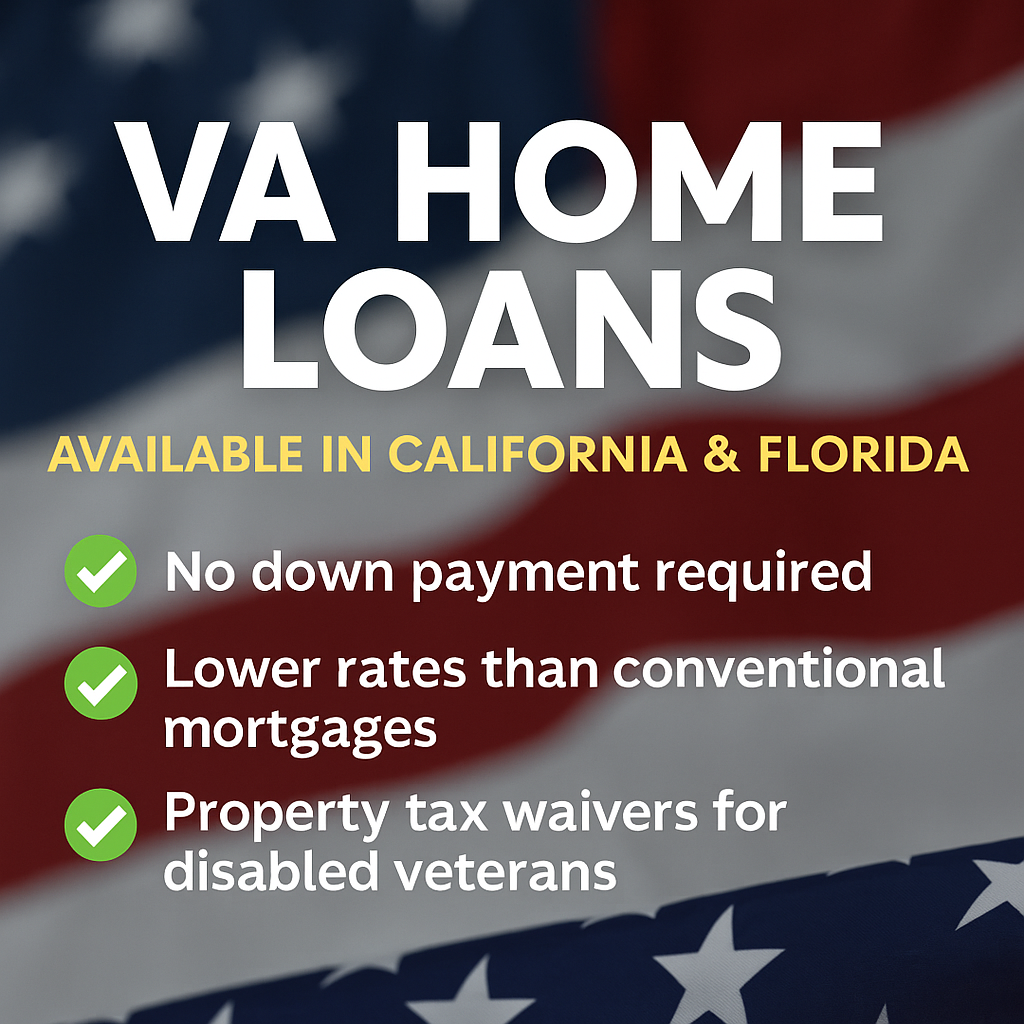

Verify my mortgage eligibility (Feb 15th, 2026)At Elixir Mortgage Lending, we take pride in helping those who served our country achieve the American dream of homeownership. The VA Home Loan Program is one of the most powerful and enduring benefits available to U.S. service members and veterans - offering favorable terms, low costs, and the opportunity to build long-term wealth through real estate.

Let's explore how VA loans began, why they were created, and how veterans in California and Florida can take full advantage of them today.

🇺🇸 1. A Brief History of the VA Home Loan Program

The VA loan program was established in 1944, during World War II, as part of the Servicemen's Readjustment Act - better known as the GI Bill of Rights.

Verify my mortgage eligibility (Feb 15th, 2026)Its goal was simple but revolutionary:

To help returning soldiers reintegrate into civilian life by offering education, job training, and affordable homeownership opportunities.

Before this act, most Americans couldn't buy a home without a large down payment - often 50% or more. The VA program changed that forever.

Verify my mortgage eligibility (Feb 15th, 2026)By guaranteeing a portion of each loan, the Department of Veterans Affairs encouraged private lenders to offer favorable loan terms to eligible veterans - with no down payment and no private mortgage insurance (PMI) required.

That single innovation has helped more than 25 million veterans become homeowners.

🏡 2. Why VA Loans Are So Powerful

VA loans remain one of the most flexible and affordable mortgage options on the market today. Here's what makes them stand out:

Verify my mortgage eligibility (Feb 15th, 2026)✅ No Down Payment Required

Qualified veterans can purchase a home with zero down, making it easier to buy without draining savings.

✅ No Private Mortgage Insurance (PMI)

Unlike FHA or conventional loans, VA loans don't require monthly PMI - saving hundreds per month.

✅ Flexible Credit Guidelines

Veterans with less-than-perfect credit may still qualify due to more forgiving underwriting standards.

Verify my mortgage eligibility (Feb 15th, 2026)✅ Competitive Interest Rates

Because the VA guarantees a portion of the loan, lenders can offer lower-than-market rates.

✅ Reusable Benefit

Your VA entitlement is not a one-time benefit - it can be restored and reused as long as prior VA loans are paid off or assumed by another eligible veteran.

💼 3. How Many Homes Can a Veteran Own with a VA Loan?

A common misconception is that veterans can only have one VA loan at a time.

The truth? You can own multiple VA-financed homes - as long as your entitlement and loan limits allow.

For example:

-

You can keep your current VA-financed home as a rental and use remaining entitlement to buy another property.

-

You may qualify for a second VA loan if you have partial entitlement available.

Verify my mortgage eligibility (Feb 15th, 2026)

The key is managing your VA Certificate of Eligibility (COE) - which determines how much entitlement you have left to use.

📌 Tip: At Elixir Mortgage Lending, we'll help you check your COE and calculate remaining entitlement for your next property purchase.

♿ 4. Additional Benefits for Disabled Veterans

Disabled veterans receive some of the most significant financial advantages in the VA loan system, including:

Verify my mortgage eligibility (Feb 15th, 2026)✅ VA Funding Fee Waiver

If you receive VA disability compensation, you are exempt from the funding fee, which can save thousands at closing.

✅ Property Tax Exemptions

Many states, including California and Florida, offer property tax reductions or full exemptions for disabled veterans.

✅ Adapted Housing Grants

Veterans with service-connected disabilities may qualify for Specially Adapted Housing (SAH) grants to modify or build homes for accessibility.

Verify my mortgage eligibility (Feb 15th, 2026)🌴 5. VA Loans in California and Florida - How We Help

At Elixir Mortgage Lending, we proudly serve veterans and active-duty service members in both California and Florida, offering hands-on guidance through every step of the process:

How We Help You:

1️⃣ Check VA eligibility and entitlement (COE assistance)

2️⃣ Compare rates and loan options with your financial goals

3️⃣ Streamline approval and underwriting with our experienced VA team

4️⃣ Coordinate with agents and escrow to ensure smooth closings

Whether you're buying your first home, refinancing, or relocating between bases, our team ensures you get the maximum VA benefit available.

Verify my mortgage eligibility (Feb 15th, 2026)💡 6. Pros and Cons of VA Loans

| Pros | Cons |

|---|---|

| No down payment required | VA funding fee (unless exempt) |

| No PMI | Must occupy as primary residence (at least initially) |

| Flexible credit & income standards | Limited use for vacation/investment properties |

| Lower interest rates | Slightly longer processing times due to VA paperwork |

🧭 Final Thoughts

For over 80 years, VA loans have empowered veterans to achieve the dream of homeownership - with unmatched flexibility and long-term value.

Whether you're buying your first home, refinancing, or leveraging your VA entitlement again, Elixir Mortgage Lending stands ready to guide you.

Your service deserves a lending experience built on honor, integrity, and results.

📞 Call 800.558.0496

🌐 ElixirMortgageLending.com

Serving Veterans in California & Florida

NMLS# 1704105 | BRE# 01901050