How to Get Ahead of Your Mortgage Application

The Steps, Documents & Expectations Every Borrower Should Know

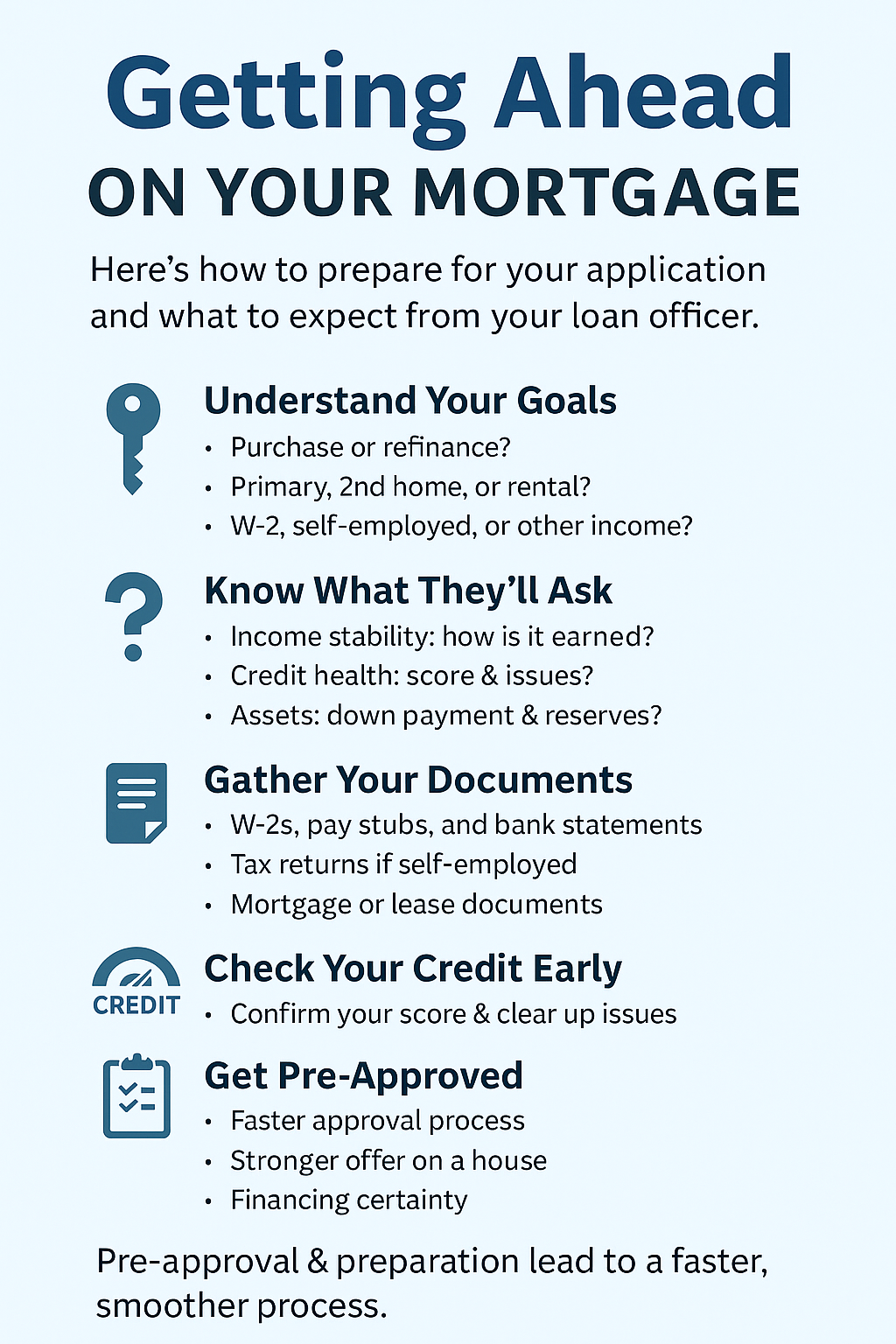

Whether you’re buying a home or refinancing, one thing is always true:

Being prepared makes the entire mortgage process faster, smoother, and less stressful.

At Elixir Mortgage Lending, we've helped thousands of borrowers in California, Florida, and across the country. And nearly every successful loan starts the same way - with preparation.

Below is a simplified guide to help you get ahead of your mortgage, understand what your loan officer will ask, and know exactly which documents you'll need.

✅ Step 1: Understand Your Loan Goals

Before your loan officer asks for anything, they'll want to understand:

Verify my mortgage eligibility (Feb 15th, 2026)-

Are you buying or refinancing?

-

Are you looking for the lowest payment, fastest approval, or most equity?

-

Is this a primary home, second home, or investment property?

Verify my mortgage eligibility (Feb 15th, 2026) -

Do you have W-2 income, self-employment income, rental income… or none of the above?

The clearer your goals, the faster we can match you with the right loan program - Conventional, FHA, VA, Jumbo, DSCR, Bank Statement, Bridge, Hard Money, etc.

✅ Step 2: Know What a Loan Officer Will Ask

Loan officers are trained to assess three core areas:

Verify my mortgage eligibility (Feb 15th, 2026)1️⃣ Income Stability

-

How do you make money?

-

Is it W-2, 1099, self-employed, rental income, retirement income, or a blend?

-

Has your income been consistent over the last 2 years?

Verify my mortgage eligibility (Feb 15th, 2026)

2️⃣ Credit Health

-

Do you know your score?

-

Are there late payments, collections, or disputes?

-

Have you had a bankruptcy or foreclosure?

Verify my mortgage eligibility (Feb 15th, 2026)

(Bonus: As of Nov 2025, VantageScore becomes a new option - helpful for more borrowers.)

3️⃣ Assets & Reserves

-

How much do you have for down payment?

-

Are the funds seasoned?

Verify my mortgage eligibility (Feb 15th, 2026) -

Will you have reserves after closing?

None of this is about judgment - it’s about structuring your approval correctly and positioning your file for success.

✅ Step 3: Gather Your Documents Early

Every loan type requires different documents, but below is the universal list for most borrowers.

Verify my mortgage eligibility (Feb 15th, 2026)📄 Documents for W-2 Employees

-

Last 2 years W-2 forms

-

Last 30 days of pay stubs

-

Most recent 2 months bank statements

Verify my mortgage eligibility (Feb 15th, 2026) -

Driver's license or ID

-

Homeowner's insurance info (if refinancing)

📄 Documents for Self-Employed Borrowers

Depending on the program, you may need:

Verify my mortgage eligibility (Feb 15th, 2026)-

Last 1 - 2 years full tax returns (personal & business)

-

Year-to-date P&L statement

-

1099s

Verify my mortgage eligibility (Feb 15th, 2026) -

Corporate documents (LLC, S-Corp, etc.)

OR choose alternative programs like:

-

Bank Statement loans (12 - 24 months bank statements, no tax returns)

Verify my mortgage eligibility (Feb 15th, 2026) -

P&L-Only Loans (CPA or tax preparer prepared)

-

DSCR Loans (no personal income docs at all)

📄 Documents for Refinances

-

Current mortgage statement

Verify my mortgage eligibility (Feb 15th, 2026) -

Homeowner's insurance declaration

-

HOA dues (if applicable)

-

Most recent mortgage payoff quote

Verify my mortgage eligibility (Feb 15th, 2026)

📄 Documents for Investment Loans

-

Lease agreements

-

DSCR rent schedule

-

Entity docs (if purchasing under LLC)

Verify my mortgage eligibility (Feb 15th, 2026)

✅ Step 4: Check Your Credit Early

A pre-approval pulls your credit, but checking your credit ahead of time allows:

-

Dispute removal

-

Debt payoff planning

Verify my mortgage eligibility (Feb 15th, 2026) -

Eliminating errors

-

Increasing your approval amount

-

Reducing your interest rate

Verify my mortgage eligibility (Feb 15th, 2026)

Pro Tip: Don't open new credit accounts, buy a car, or finance furniture before closing your mortgage.

✅ Step 5: Get a True Pre-Approval

A true pre-approval is stronger than a pre-qualification and includes:

-

Full review of your credit

Verify my mortgage eligibility (Feb 15th, 2026) -

Document verification

-

Automated underwriting approval (DU/LP findings)

-

Income & asset confirmation

Verify my mortgage eligibility (Feb 15th, 2026)

This makes your offer stronger - especially in competitive markets like San Diego, Los Angeles, Orange County, and Miami.

✅ Step 6: Stay Communicative During the Process

The fastest loan closings happen when borrowers:

-

Respond quickly to requests

Verify my mortgage eligibility (Feb 15th, 2026) -

Upload documents on time

-

Keep the same financial profile during escrow

-

Tell the loan officer about any job changes or deposits

Verify my mortgage eligibility (Feb 15th, 2026)

Your loan officer is your partner - the more we know, the more solutions we can create.

🧭 Final Thoughts

Getting ahead of your mortgage application doesn’t require perfection - just preparation.

When you know what your loan officer will ask, and you have the right documents ready, you take control of the process. This leads to:

Verify my mortgage eligibility (Feb 15th, 2026)-

Faster approvals

-

Lower stress

-

Better loan options

Verify my mortgage eligibility (Feb 15th, 2026) -

Stronger offers

-

Smoother closings

At Elixir Mortgage Lending, we guide you through every step with clarity and a personal, one-on-one approach.

Verify my mortgage eligibility (Feb 15th, 2026)If you're ready to get pre-approved or want help preparing your documents:

📞 800.558.0496

🌐 ElixirMortgageLending.com

NMLS #1704105 | BRE #01901050