Conventional & FHA Loans in Aliso Viejo — Plus the Big Credit Score Change Coming November 16, 2025

What Homebuyers & Homeowners Need to Know in Today's Market

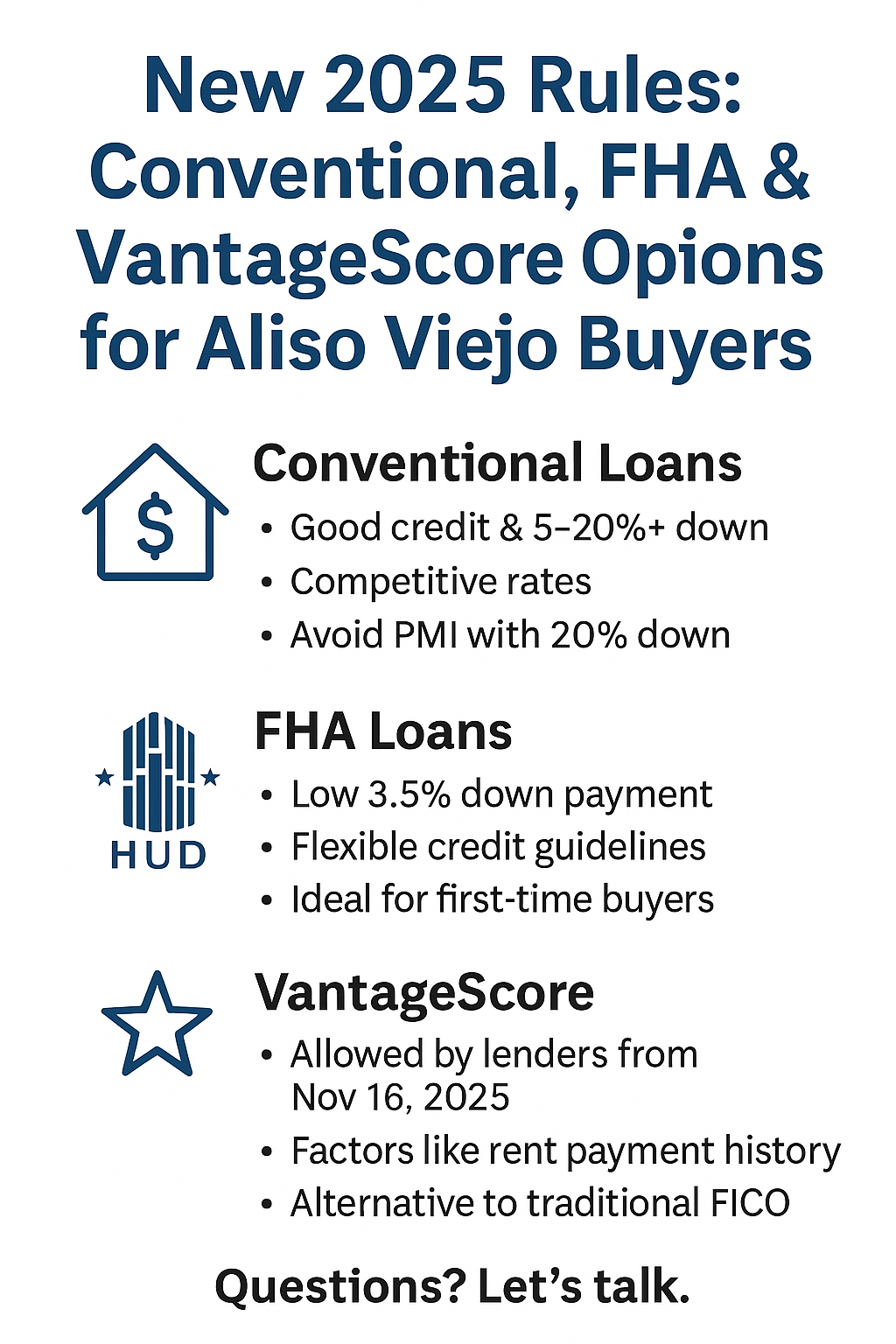

The mortgage landscape is shifting quickly - especially in Aliso Viejo, where home values, lending standards, and borrower profiles continue to evolve. One of the most important updates arriving this year is the integration of VantageScore as an allowable credit scoring model for certain mortgage programs beginning November 16, 2025.

Verify my mortgage eligibility (Feb 15th, 2026)If you're considering buying or refinancing, this expanded credit-scoring option opens the door for more families to qualify - especially those underserved by traditional FICO scoring.

In this blog, we'll break down:

-

The difference between Conventional and FHA loans

Verify my mortgage eligibility (Feb 15th, 2026) -

How the VantageScore change affects borrowers

-

What this means for Aliso Viejo homebuyers and homeowners

-

Where Reverse Mortgage options also fit in

Verify my mortgage eligibility (Feb 15th, 2026) -

How to decide which loan is right for you

🏠 1. What Are Conventional Loans?

Conventional loans are the most common type of mortgage and are not backed by a government agency. They're ideal for borrowers with solid credit, steady income, and a down payment of 5 - 20%.

✔️ Key Benefits of Conventional Loans

-

Competitive rates

Verify my mortgage eligibility (Feb 15th, 2026) -

No mortgage insurance with 20% down

-

Flexible terms (15 - 30 years)

-

Great for high-credit borrowers

Verify my mortgage eligibility (Feb 15th, 2026)

✔️ Why Aliso Viejo Buyers Choose Conventional

Aliso Viejo has above-average home values, meaning buyers often use conventional financing to secure strong pricing and avoid strict FHA guidelines.

🧰 2. What Are FHA Loans?

FHA loans, backed by the Federal Housing Administration, are perfect for buyers with lower credit scores or smaller down payments.

✔️ FHA Loan Highlights

-

Down payments as low as 3.5%

Verify my mortgage eligibility (Feb 15th, 2026) -

Flexible credit scoring

-

Great for first-time homebuyers

-

Allows higher debt-to-income ratios

Verify my mortgage eligibility (Feb 15th, 2026)

✔️ Why FHA Works in Aliso Viejo

Aliso Viejo attracts many first-time buyers and young families. FHA makes it easier to enter the market even if your credit or savings aren't perfect.

⭐ 3. The Big Update: VantageScore Becomes an Option - November 16, 2025

Beginning November 16, 2025, Fannie Mae and Freddie Mac will begin accepting VantageScore 4.0 on mortgage applications (rolling out in phases). This is a major development.

✔️ Why This Matters

Traditional FICO scores don't always reflect modern financial habits - especially for:

Verify my mortgage eligibility (Feb 15th, 2026)-

Self-employed borrowers

-

Renters

-

Gig workers

Verify my mortgage eligibility (Feb 15th, 2026) -

Borrowers with thin credit files

-

Those recovering from past challenges

VantageScore weighs factors differently, which means more borrowers may qualify or receive improved pricing.

Verify my mortgage eligibility (Feb 15th, 2026)✔️ Key VantageScore Advantages

-

Considers rental and utility payment history

-

Less punitive on medical collections

-

More consistent scoring across all 3 credit bureaus

Verify my mortgage eligibility (Feb 15th, 2026) -

Helps borrowers with limited credit history

For Aliso Viejo buyers, this opens the door to more approvals, better rates, and greater affordability - especially when paired with FHA or Conventional options.

🏡 4. Reverse Mortgage Options in Aliso Viejo

(Great for Seniors 62+ Who Want Stability & Flexibility)

With rising property taxes, insurance costs, and medical expenses, many homeowners in Aliso Viejo are turning toward Reverse Mortgages to unlock home equity without monthly payments.

Verify my mortgage eligibility (Feb 15th, 2026)✔️ Benefits of Reverse Mortgage Aliso Viejo Options

-

No monthly mortgage payments

-

Access cash as a lump sum or line of credit

-

Stay in your home long-term

Verify my mortgage eligibility (Feb 15th, 2026) -

Spousal protections included

-

Tax-free access to your equity

Reverse mortgages are especially helpful for retirees on fixed incomes who want to reduce expenses or increase financial flexibility.

Verify my mortgage eligibility (Feb 15th, 2026)🔎 5. Which Loan Should You Choose?

Here's a quick guide to help you decide:

✔️ Choose Conventional if:

-

You have strong credit

-

You're putting 5 - 20% down

Verify my mortgage eligibility (Feb 15th, 2026) -

You want no PMI

-

You want the best long-term pricing

✔️ Choose FHA if:

-

Your credit needs improvement

Verify my mortgage eligibility (Feb 15th, 2026) -

You want a low down payment

-

You're a first-time buyer

-

You need flexible underwriting

Verify my mortgage eligibility (Feb 15th, 2026)

✔️ Choose a Reverse Mortgage if:

-

You're 62+

-

You want to eliminate mortgage payments

-

You want to access home equity for retirement stability

Verify my mortgage eligibility (Feb 15th, 2026)

✔️ Choose VantageScore-Evaluated Loans (starting Nov 16, 2025) if:

-

Your FICO is lower than your VantageScore

-

You have non-traditional income

-

You rely on rental/utility history to show responsibility

Verify my mortgage eligibility (Feb 15th, 2026)

🧭 Final Thoughts - Aliso Viejo Borrowers Have More Options Than Ever

Between Conventional, FHA, Reverse Mortgages, and the new VantageScore update, the mortgage landscape is expanding in ways that help more families qualify and secure competitive pricing.

Whether you live in Aliso Viejo today or are planning a move into this thriving community, you deserve a lender who can explain options clearly and tailor a plan around your financial goals.

That's exactly what we do.

📞 800.558.0496

🌐 ElixirMortgageLending.com

NMLS# 1704105 | BRE# 01901050